This might be something entirely new to many of you who are no where interested or connected to Economics (not as in the subject but the day to day stuff :P). Taxation is an integral part of eco and has always been an important subject for becoming a successful Chartered Accountant or Company Secretary. Many of my friends doing CA still struggle with this !

Anyways getting to the topic. Filing income tax return is an important thing. To make things simpler, let me explain what is this and why are IT Returns filed ?

When you are working in an organization, a certain amount of tax is deducted from your salary. This is known as Tax Deduction at Source or TDS. This basically means that the income tax has been already deducted from your salary and you dont need to pay anything now. The companies generally make a rough estimate and deduct the tax.

Many a times, the amount of tax deducted is more than the tax that is actually required to be submitted. i.e. a tax of 45000 is required and the company has paid a tax of 46500. In such cases, the excess amount needs to be returned. So to get that excess amount the person fills up and submits the Income Tax Return. To do so Form 16 is required(issued by the employer) along with ITR-1 for individuals.

The process of filing is easy and I have been doing this for quite some time now. But what if you make a mistake in filing ? What if you have already uploaded the xml file / filed the return ? How to make changes to it ?

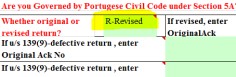

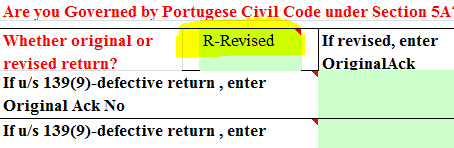

Well, its simple (based on my experience). Simply open the ITR 1 form and you shall find an option called Whether Original or Revised. Select Revised from the option. Now under the Return Filed under section, choose 17-Revised 139(5).

That’s it. Validate and Generate the xml file and upload it on the income tax website.

I hope this document helped you people ! And all you CA’s and Taxation professionals, do rate me on this !!

SocialMaharaj Technology, Travel, Food et al

SocialMaharaj Technology, Travel, Food et al