Don’t put all your eggs in one basket, is a popular quote especially when it comes to investments. A famous money lesson that is widely shared and accepted. It basically means that one shouldn’t put all their money into the same financial instrument, it’s always advisable to spread them out to safeguard your principal in case of any unforeseen circumstances.

I feel that this quote can be applied to everything else in life as well. But what I want to share today is one instance where I didn’t follow this and I’m regretting it. I’m sure many of us use PayTM for making financial transactions, and for many (including me) that’s the only wallet we have.

And that’s what is literally stopping me from going on a road trip today. That’s because of the never-ending PayTM KYC woes. I’ve had such an awful experience with PayTM that I feel this whole PayTM KYC is a scam.

While I didn’t plan to write this earlier, I felt that this needs to be put out for others to know. I thought that I was the only one who was facing this issue. But when I tweeted this to PayTM, I realised that I’m not the only one. So in this blog post, I share what is the issue and why I feel PayTM KYC is a scam.

Wallet Apps & KYC

Before I get into the actual issue, let me help you understand the rules around wallet apps and KYC laid down by the RBI. (Another reason I like writing such blog posts is that I get to research and in the process learn something) In this section, I’ll be referring to the Master Directions on Prepaid Payment Instruments circular that was last updated in November 2021. While there’s everything laid out clearly in that document, I’ll be focusing on specifics for this post.

Type of Wallet Apps

RBI has two major types of wallets, Prepaid Payment Instruments as called by the RBI – Small PPIs & Full KYC PPIs.

Small PPIs

Small PPIs are basically wallets wherein you cannot have more than 10,000 Rs at any given point in time. Some small PPIs are also allowed to provide cash loading facility and for such wallets, you cannot load more than 10,000 Rs in a month. So whatever you do, with these types of wallets, you cannot have anything more than 10,000 Rs. Also, such wallets don’t allow fund transfers or cash withdrawals.

Such wallets can be opened with minimum details that include a verified mobile number with OTP, a self-declaration along with a name and an identification document. Further, such wallets have to convert to Full-KYC wallets after 24 months failing which no credit can be added to this wallet. This is my case.

Full-KYC PPIs

As the name suggests, these wallets can have a maximum of Rs 2,00,000 Rs at any given point. And with these wallets, you can do everything from shopping to cash withdrawal and transfer. The requirement here is that these wallets have to be opened only after KYC verification. And after the latest amendment, Video-based KYC can be used to open full-KYC PPIs and convert existing PPIs as well.

This is the bare minimum I feel we should know for this blog post. But I’d suggest reading the circular to understand more about these wallets and the larger scam these guys might be running.

My PayTM Wallet Story

I opened a PayTM account long back and I don’t remember when. It was a normal wallet account and I also don’t know to remember when the KYC was done (if it was). In the pre-UPI era, I used to use the wallet quite a lot for various purchases. However, post-UPI, the usage dwindled. While I did have the app on the phone, I barely used it. And me being me, I didn’t want to use any non-bank UPI app. Though PayTM prompted me to get a UPI id via PayTM, I always skipped it.

After I got my Tata Punch, I restarted using the wallet. My dealer affixed a PayTM Fastag in my car. And the PayTM wallet would be used to fund the fastag. That meant I had started using my account. I start loading cash in it as per my needs. Sometimes from my bank account, sometimes using my credit card. While I don’t know the exact amount, I don’t think it would have been more than 10,000 at any given point.

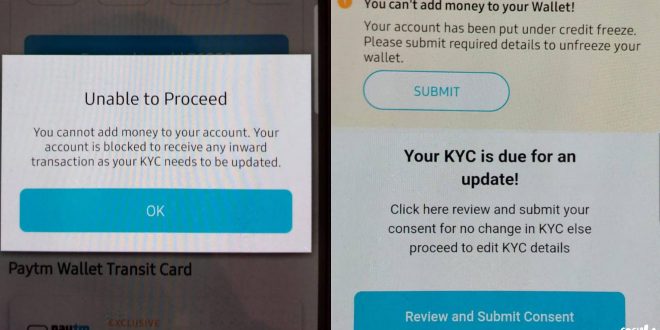

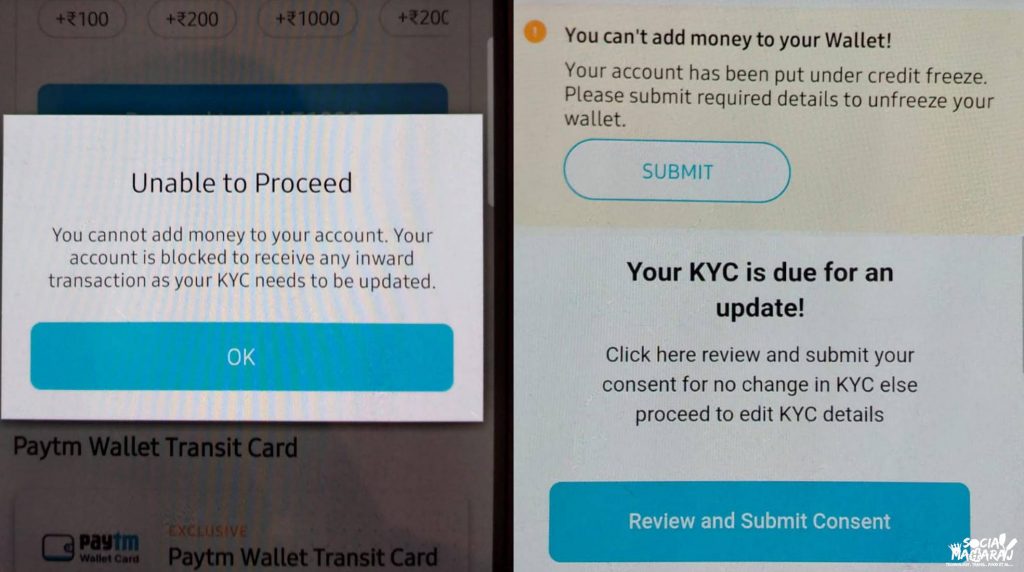

Anyways, a few months into this I started getting a KYC-required message. Though I was still able to use my PayTM wallet. However unexpectedly while I was driving, I checked the app and it said, your PayTM wallet is deactivated, and you need to complete Full-KYC to be able to load money into it.

Since I was on the road and I had a PayTM Fastag, I was worried as I’ll have to pay double toll tax if the wallet ran out of money. So I opened the app, found the UPI id for fastag and tried to do a transfer from my ICICI Bank UPI app. Well that failed, because apparently that’s linked to the PayTM wallet and the wallet cannot have any money loaded until the KYC is complete.

Now, this was a problem, I had two options:

- Get rid of PayTM (easy)

- Get the KYC done

So I first tried getting the KYC done. And here’s where I felt that PayTM KYC is a scam.

Why Do I Feel PayTM KYC Is A Scam?

Now that I had to get the KYC done, I opened the app and thought to get this done immediately. To my surprise, in this digital age, they want me to go to a physical store and verify my documents and get the KYC done.

On one side I have banks and credit card companies doing video-based KYC and giving me the services within a few minutes, PayTM wanted me to go to their partner stores to get this done. As a product manager, this is a red flag, users will drop out if they see friction, at least I will.

KYC At Stores

Nonetheless, I decided to go to one of these partner stores and get the KYC done. Not 1 but 5 stores I went to for getting the KYC done. Out of 5, 4 stores asked me Rs 100 to get the KYC done, I was surprised. (Scam?) I called PayTM customer care to get this validated and they told me KYC is free. When I conveyed the same to the store, they told me to do the KYC somewhere else.

PayTM does have a complaint mechanism but that requires the name of the agent and their mobile number, do you think they’ll give these details to me when they know that I want to raise a complaint against them? I visited 4 stores, and all of them asked for money. That’s when I tweeted to get this mess sorted.

Every passing day was a problem for me as I travelled by ORR in Hyderabad and have to pay a toll. If I didn’t have money in my wallet, I had to pay double.

Eventually, one of their “preferred partners” did it, but asked for cash after the process was done. When I told him that I’ll complain, he told me I could go and not pay the ‘mandatory fee‘. I quickly checked the app, and it still said the wallet is deactivated and KYC is required. I rechecked after a couple of days, it’s the same story.

I was furious and dialled customer care. And apparently, they need to verify the address (I was like Aadhar has already verified it, why PayTM wants to do it?) Apparently, a letter will be sent within 10 days to your address to verify it. There will be some QR code that you need to scan. Once done, your address will be verified, KYC will be complete and the wallet will be re-activated.

It’s been over 2 weeks and I haven’t received anything. The entire banking world has moved to video-based KYC, and PayTM still mandates visiting some random tea stall to get the KYC done to use the wallet. Probably why the company’s stock prices are in tatters, 70% lower than what it was when the IPO was released.

Closing the PayTM Account

The next logical step for me was to close the PayTM wallet and get a new Fastag. More than the wallet, Fastag was important. While I could have got another fastag and started using it while doing this process. I was done with PayTM, won’t settle for anything less than deactivating my PayTM wallet.

When I wanted to do this, I couldn’t find an option to deactivate Fastag from the app, and I need to find an option to deactivate the wallet/account as well. And apparently, you cannot transfer the amount from your wallet to the bank until the KYC is done.

I have a few thousand rupees in my wallet while the PayTM folks do nothing. However, the same RBI circular says that the money can be returned to the source from where it was loaded into the wallet without any KYC. Any PayTM doesn’t have this option from my understanding at the moment.

So, I’m stuck with a non-functioning PayTM wallet that is hampering my movement because I cannot use the Fastag and a dubious KYC process which is one of the worst I’ve seen. So is PayTM KYC a scam really? Well, it may or may not be.

Scam might be a harsh word that I’m using. But my experience with it made me term it as a scam. Not one but 5 stores, some of them ‘preferred partners’ are asking for money and PayTM doesn’t have a video KYC process in place. So eventually I pay 100 Rs each time I need to get a KYC done.

Based on the rules, it’s clear that video KYC can be done, so why is PayTM still mandating in-person KYC verification? Why they don’t send people home in such cases to get the KYC verified? Why should I pay these agents to get the verification done?

Sounds like a scam to me.

What next?

Well, there are moments, when I feel I should let go of things and not waste my time. However, this one doesn’t seem like that one. All would have been fine had the PayTM guys stuck to the process and completed the KYC. Just because I had to travel to these stores and there weren’t many in my area, and all of them asking for money made me furious. The reason why I decided to write this blog post.

Most of these business entities exploit their customers because they don’t know about the regulations around them. Tell me how many of you had seen this master document that I shared earlier in this post? I’m sure none of you. And after having written this blog post, I want closure. So the next step would be to reach out to the RBI ombudsman with the issue and see if that works.

I’ll get these answers from the RBI ombudsman (hopefully) and keep you all posted. Eventually, I want to help you understand what is right. If you’re a PayTM customer, let me know if you’ve faced an issue with the PayTM KYC wallet. Is your KYC process complete? How was your experience? Let me know your thoughts in the comments below, tweet to me at @Atulmaharaj, DM on Instagram or Get In Touch.

SocialMaharaj Technology, Travel, Food et al

SocialMaharaj Technology, Travel, Food et al