I fondly remember that it was my first day of corporate life and we were doing the onboarding formalities. One of the items on the list was to get a salary account opened. There were various kiosks of different banks on the campus and we had to simply share a few things with them and the account was opened. So while I opted for ICICI Bank, they also gave me a Coral credit card. while I wasn’t quite aware of it, it had Bookmyshow tickets free every month, so I took it.

Only later I realized the true benefits of having a credit card. My next card was Diners Club Miles, which was later upgraded to Diners Club Privilege. The latest entrant to my list of credit cards is the Amex Rewards credit card popularly known as Amex MRCC.

In this blog post, I’ll share a few basic tips for any newbie to maximize reward points on the Amex membership rewards credit card and also share a bonus referral link to help you get the best benefit when you opt for an AMEX card without paying the joining fee.

Why Have A Credit Card?

The first and foremost question is why should you have a credit card when you have a debit card. I’d say for the benefits it brings to the table. Since it’s a credit (loan) that the bank offers you, they also provide you with lots of benefits along with the card. From free movie tickets to airport lounge access, hotel stays, and even flight tickets! Based on the type of card you have, you will have different benefits to choose from.

Further, I’d also add that every card comes with a fixed limit. So can’t spend more than that. Hence it also makes sense to use your credit card over a debit card wherever possible. That way even if there’s a fraudulent transaction, it’ll never be more than your limit.

However, the most critical aspect of owning a credit card is to ensure that you are paying the bills on time. Not the minimum due amount, but the total outstanding amount. If you’re someone who can pay the complete outstanding amount, then you must use a credit card to reap maximum benefits.

My First Amex Rewards Credit Card

My ICICI Coral credit card and both Diners Club Privilege give me airport lounge access, which is the most important. Ever since I bought my new car Tata Punch, my fuel expenses rose and I was looking for a card that gave me some benefits. After looking at other fuel-based credit cards, I was looking for other options as most of the co-branded credit cards I had to drive to a particular pump.

Instead, I was hunting for a card that provided good reward points and that’s when I signed up for Amex MRCC rewards credit card. The goal is to try and move all the household spending to Amex and convert the rewards points to Vistara Airmiles or Marriott Bonvoy points to fund my travel needs 😉

So it’s been close to a month, and I’ve already earned 7000+ points (including the welcome bonus of 4000) & below are a few ways to maximize your rewards points using the Amex rewards credit card.

3 Ways To Maximise Points + Bonus Referral

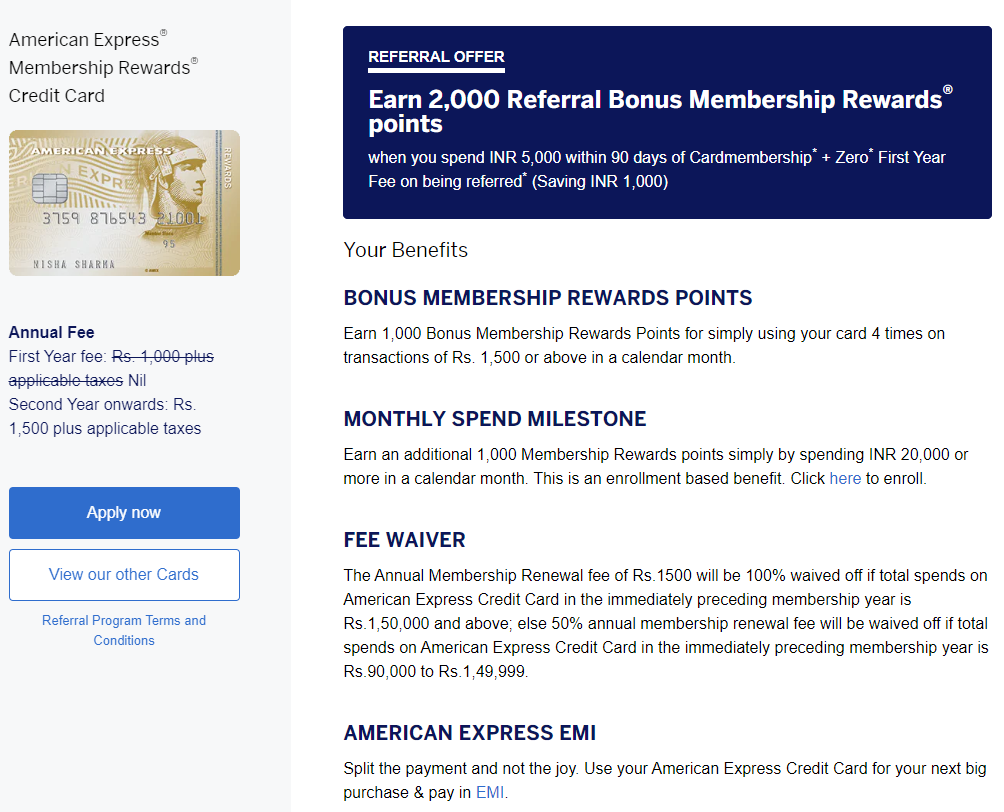

4 Transactions of Rs 1500 monthly for 1000 points

Make 4 spends of Rs 1500 every month and earn 1,000 bonus membership rewards points. So you simply need to make four transactions of at least Rs 1500. You can use it for buying groceries, shopping online, mobile bills, etc. Basically, any fixed expenses you have monthly can be made using Amex MRCC to get extra 1000 points over and above the 1 point for every Rs 50 spent.

Note: You also get points when you load your wallet, which isn’t valid for other cards. So you can load your PayTM, Amazon, PhonePe, and other wallets. However, some do charge extra to load money using a credit card, but there are ways to load the wallet without paying any extra charge.

Spend Rs 20,000 monthly for 1000 points

Another benefit of having Amex MRCC is that you can get additional 1000 reward points if you spend more than Rs 20,000 monthly. For any normal household, I assume monthly expenses would be this much including your monthly grocery, utility bills, etc. So if you’re able to spend at least Rs 20,000 monthly, then this Amex MRCC is the best for you as you get 1000 bonus points every month.

Earn 2X Reward Points via Rewards Multiplier

The next best way to maximize reward points is to buy electronic gift vouchers from Amex’s rewards multiplier platform. Any spend on this portal will give you 2x rewards points for Amex MRCC. Plus many gift vouchers on this platform are available at a discount.

For example, BigBasket coupons are available at a discount. I buy a Rs 1000 coupon for Rs 800 and earn 2x reward points on it. So I load my BigBasket wallet using this gift voucher and use it.

Citibank never reverted to my credit card application till date, been 5+ years.

— Atulmaharaj (@Atulmaharaj) November 9, 2022

Applied for @AmexIndia MRCC online, 3rd day the card was home. No salary slips, no address proofs. Nothing.

This is the service you want!

Now let's see how this one turns out to be.

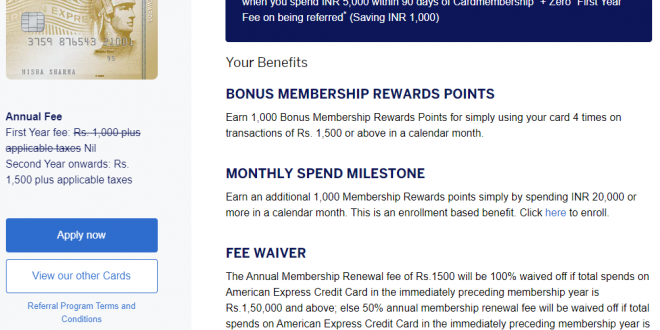

Bonus Referral Link for Amex MRCC

Amex was banned from selling credit cards for the past few months. However, they have now opened up registrations and I was one of the many people who opted for an Amex MRCC. One of the interesting things that Amex does is its classic referral program.

So if you are an Amex user, you’ll have the option to earn more points if someone you referred is onboarded on Amex. Also, the person whom you refer doesn’t have to pay any joining fee plus a reduced renewal fee. You can use my referral link to apply for an Amex credit card and get these benefits.

If you have any further queries regarding Amex MRCC, please feel free to drop them in the comments below, tweet to me at @Atulmaharaj, DM on Instagram or Get In Touch.

SocialMaharaj Technology, Travel, Food et al

SocialMaharaj Technology, Travel, Food et al